Introducing Finances

Introducing the Finance Tab in Wisenet.

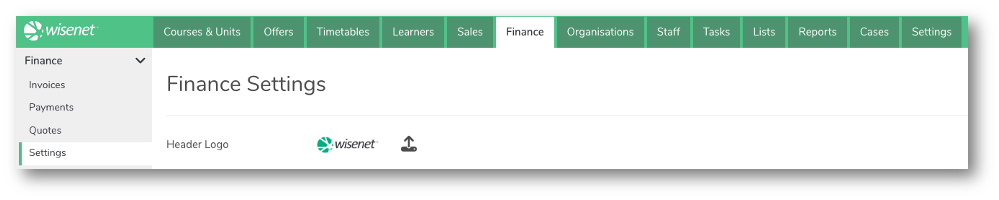

Navigating to LRM > Finance allows you to manage all finance related features including setting up your finance settings.

Get an insight below into all the finance related features and how to manage each.

Finance Settings

Finance Settings is a one-time step to complete before you can start using any of the related features.

This is where you set up your trading account details; customise how your finance features will look, i.e. your Quote Email Template, and add additional details such as your default currency and terms and conditions.

LEARN MORE: Finance Settings

Invoices

Invoices in Wisenet is an online feature that allows you to process and issue online invoices for Learner and Course Enrolments from within the Wisenet application.

When a Learner / Course Enrolment receives an invoice, they view and pay the invoice online and can download a PDF version of the invoice as a copy.

LEARN MORE: Online Invoices

Payments

A log of payments made against an invoice is visible in Wisenet under the Finance > Payments section.

Use the filter and/or quick search functionality on the Payments page to view Payment Details.

LEARN MORE: Introducing Payments

Quotes

The Quotes feature in Wisenet helps organisations to create, issue and manage quotes. As a training organisation, you have the potential in meeting your customers’ needs with a flexible feature that allows you to draft and edit quotes that match exact customer requirements before finalising them.

Once a quote is created and finalised at the organisation’s level, issuing a quote will also automatically send the quote via email to the customer. Attached in the email is the Quote link that is viewed online with the option to also download the quote as PDF.

LEARN MORE: Quotes